The credit score requirements for individuals to qualify for personal loans varies from one lender to the next. The vast majority of creditors favor borrowers with excellent or good credit scores (690 FICO or better), although certain creditors will consider people with terrible credit as well (below 630).( https://www.pensacolavoice.com/tax-planning-secret/ ) According to an unnamed database […]

How to Obtain a Loan Without Having Your Credit Checked 2022| Oak Park Financial

Do you need to finance something that doesn’t fit neatly into a loan category like a house or a car loan? Because of the borrower’s freedom, private loans can be utilized to finance a wide range of goods. Bureau of Consumer Financial Protection (CFPB). But that doesn’t rule out the possibility of something better. Continue […]

These Hollywood Stars Are Liza Soberano’s New Instagram Followers

Kathryn Newton in this photo from her Instagram on July 29, 2022 (left), Liza Soberano in this photo from her Instagram on June 21, 2022 (center) and Cole Sprouse in this photo from her Instagram on January 17, 2021 (right) It’s official Instagram. Actress Liza Soberano is now followed by Hollywood actors Catherine Newton and […]

Not only India but also Hindu customs love these Hollywood actors

There is a saying that the essence of all religions is one. This is why we may be attracted to other religions besides our religion and want to know more. There have been many such Hollywood stars who when they came to India could not stop without visiting the temples here. Not so long ago, […]

Hollywood actors Sean Penn and Leila George finalize divorce

Hollywood star Sean Penn and actress Leila George, who married in July 2020, have finalized their divorce after almost two years of their marriage. According to people.com, the Oscar-winning actress, 61, and Australian actress, 30, first fell in love in 2016. George then filed for divorce in October 2021 after just over a year of […]

What is the Tarantino Effect? How He Changed Hollywood Movies

Quentin Tarantino is one of the most influential filmmakers in the industry, and he gave way to the “Tarantino Effect,” which has two definitions depending on the context. Tarantino has won praise and respect from audiences and critics alike with his signature visual and narrative style, although he and his works have also been shrouded […]

Breaking: Hollywood stars sign up for new Kilkenny Cartoon Saloon film

Hollywood’s biggest stars have signed up for a new Oscar-nominated Cartoon Saloon animated film – unveiled today (Wednesday). The production from the Kilkenny-based animation studio is set to join the ranks of original films made for Netflix. Led by Nora Twomey, the voice cast includes a who’s who of top young theater talent and legends […]

Jane Fonda to Elizabeth Banks: These Hollywood actors wore the same dress twice on the red carpet

” class=”lazy img-responsive” data-src=”https://www.iwmbuzz.com/wp-content/uploads/2022/03/bold-in-black-dhvani-bhanushali-knows-how-to- style-black-outfits-see-pics-here-2-920×518.jpg” width=”920″ height=”518″ alt=”Jane Fonda to Elizabeth Banks: These Hollywood actors wore the same dress twice on the red carpet” / > With sustainable fashion gaining traction, Hollywood superstars bring their A game to red carpets year after year by recycling outdated dresses, as seen at this year’s Oscars by Jane […]

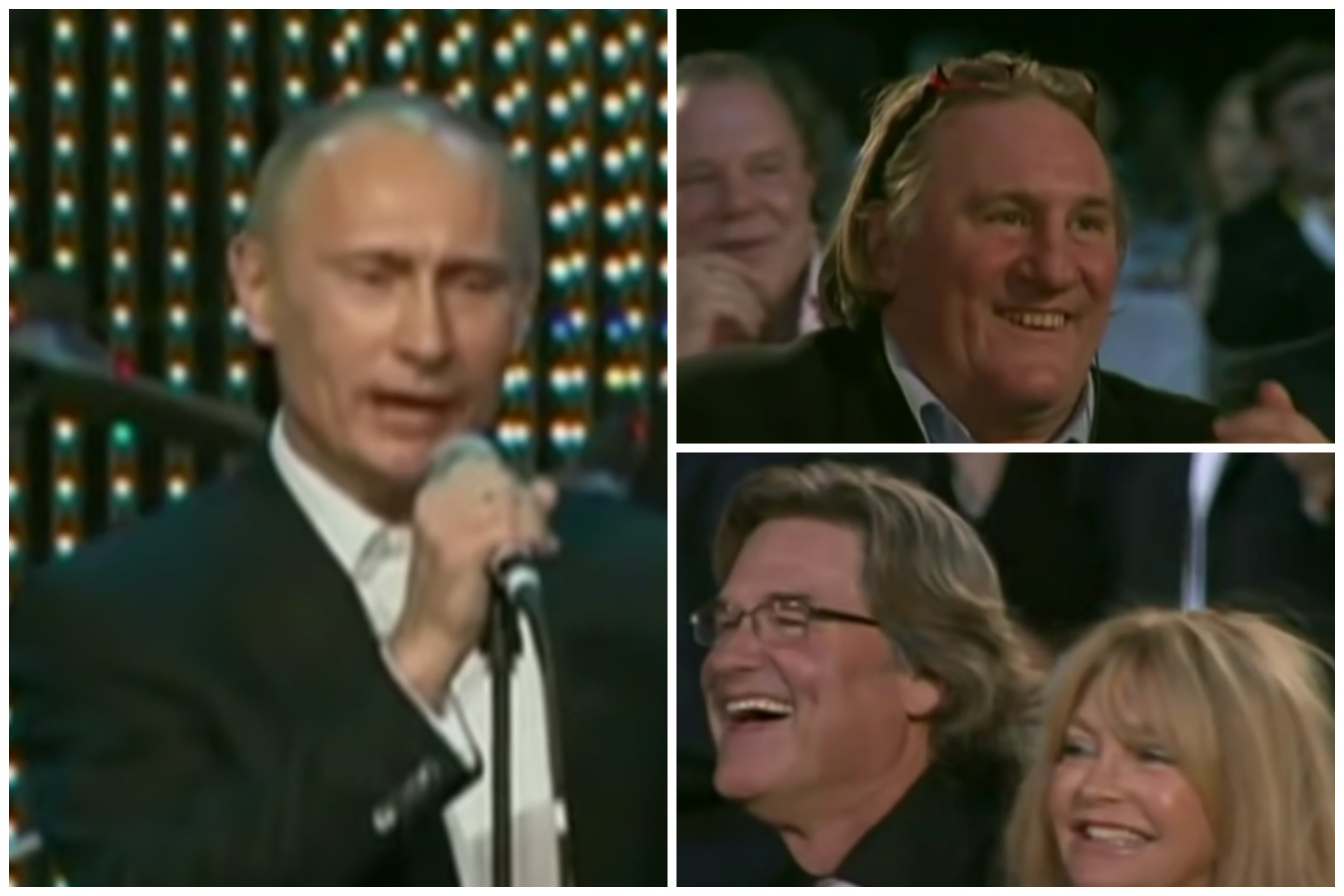

Video of Vladimir Putin singing “Blueberry Hill” in front of Hollywood celebrities resurfaces

A bizarre video of Vladimir Putin singing to a room full of Hollywood stars has resurfaced – footage that seems incredibly surreal and even eerie given the Russian president’s invasion of Ukraine which is currently dominating the news cycle . In 2010, a number of A-list celebrities attended a children’s charity event in St. Petersburg, […]

Irish Duck and Hollywood Stars – The Journey from Emyvale

Silver Hill Premium Irish Duck is a household name for many who love a good dish of Peking Duck, or pretty much anyone who lives in the Midlands or border counties. Established in 1962, the company has expanded its poultry exports, now being 70% export oriented, supplying duck and duck products to 24 countries around […]

Korean mogul Miky Le buys Endeavor content from Hollywood stars

CJ ENM Endeavor Content Billion Dollar Purchase Comes After Skydance Investment and Best Picture Award for “Parasite” Lee Byungchul’s granddaughter is already part of a South Korean media empire with her brother Lee Jayhyun. Lee will be a truly extraordinary leader with this new deal. “Modern content creator,” Lee expressed her ambition to become a […]

These 3 Hollywood celebrities are not on social networks

Social media has become a part of life and has indeed changed the way celebrities interact with the world. Through social media through which fans can get daily updates of their favorite actor or actress. He made a more accessible and consistent presence in the lives of fans. However, many celebrities have made the conscious […]

Brad Pitt, Chris Hemsworth, Johnny Depp and more: Hollywood actors who effortlessly sported their colored nails in public

“class =” lazy img-responsive “data-src =” https://www.iwmbuzz.com/wp-content/uploads/2021/10/brad-pitt-chris-hemsworth-johnny-depp-and-more- hollywood-actors-who-wore-colorful-nails-in-public-effortlessly-920×518.jpeg “width =” 920 “height =” 518 “alt =” Brad Pitt, Chris Hemsworth, Johnny Depp, and more : Hollywood actors who sported their nails colored effortlessly in public “/> Nail Paint was considered girly and gay, but not anymore. Nowadays, more and more famous Hollywood actors are wearing […]

‘Once Upon A Time … In Hollywood’ Stars Brad Pitt And Leonardo DiCaprio Avoid Bathing

One of the latest trends in celebrity health has sparked a lot of controversy. Many celebrities have shared unusual bathing habits, including Mila Kunis and Ashton Kutcher, claiming that they only bathe their children when dirt is visible. Once upon a time … in Hollywood stars Brad Pitt and Leonardo DiCaprio have also reportedly skipped […]

Peter Overton reveals the most difficult Hollywood celebrities to interview

Peter Overton has covered natural disasters, pandemics and terrorist attacks, but the most memorable moments in the Nine News journalist’s career have come from his interviews with prominent stars. Getty “I remember Bruce Willis was very, very difficult,” the Nine reporter said. “I told him that I have great admiration for him and Demi Moore, […]

10 great Hollywood movies currently filming during the pandemic

The COVID pandemic has challenged many projects and impacted millions of jobs around the world. The movie industry is no different. Everything was shut down in March, and although some productions continue to be delayed, many others have resumed under strict COVID protocols. RELATED: 10 Pandemic Movies That Are Genuinely Reassuring The film industry is […]

Hollywood Celebrities Kristen Bell and Dax Shepard Choose Waco Site to Make Hello Bello Diapers

Hollywood celebrities Kristen Bell and Dax Shepard will lease a 312,000 square foot building in Waco to set up their first wholly owned Hello Bello diaper manufacturing and distribution center. Their baby products startup Hello Bello will modernize a former Domtar personal care facility, which is expected to be completed by summer 2021. It will […]

10 Hollywood actors of Nigerian descent

Nigerian actors in Hollywood The American entertainment industry, Hollywood, has many black celebrities of African descent, especially Nigerians. Here is a list of Nigerians who were either born in Nigeria and raised overseas, born and raised outside the country, or have one or both Nigerian parents. Cynthia Erivo Cynthia Erivo A British-Nigerian actress, singer and […]

/cloudfront-us-east-1.images.arcpublishing.com/dmn/A5PYN3LLZNEZRNJ4HKARTNYBFM.JPG)